Westport’s

Ticking Time Bomb

by Richard Phillips

Westport is sitting on a ticking time bomb – unfunded employee liabilities. The Town has promised employees retirement benefits that far exceed the monies available to pay them. The bills should be paid by taxpayers in the future, in some cases, the next generation. Two items, pensions and health benefits are unfunded by at least $65.2 million, and probably more than $100 million.

In the prospectus for the 2013 Westport Bond Offering liabilities for pensions are listed as $40.1 million with an unfunded portion of $17.3 million. In the 2014 Actuarial Report for Westport liabilities for retiree health benefits are listed as $49.5 million with an unfunded portion of $47.9 million. This makes Westport’s total unfunded liabilities (pensions plus health) equal $65.2 million. This is an amount equal to 362% of the covered payroll. An unusually large number for any organization. This is the good news.

A closer look at the figures reveals that they are grossly understated. That is the bad news.

The Town is a member of the Bristol County Retirement Plan. In their actuarial calculations it is assumed that the paid in contributions will earn 8.25% and life expectancy will match the year 2000 tables published by the Social Security Administration. The actual return on the Plan’s assets has been running much less, closer to 4.12%. A lower rate of interest has a dramatic effect on the unfunded liability. For any particular plan the impact of lower interest rates depends on the precise distribution of the ages of the beneficiaries. A number of organizations have published estimates how much is involved. They all come to the same conclusion: the pension funds are grossly underfunded. For example, The Beacon Hill Institute of Suffolk University has made estimates for a number of Massachusetts public pension plans. They concluded that using more realistic interest rate of 4% would cause the total liabilities to grow by a factor of between 3.8 and 7.1.

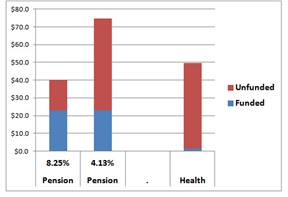

The graph below illustrates the unfunded amounts for pensions for each rate of interest as well as for health benefits.

Another factor is that the plans use mortality tables that were established in the year 2000. Since those table were adopted life expectancy has increased by approximately 3 to 4 years. Actuaries use a rule of thumb that for each year increase in life expectancy the liability increases by 5%. Applying this rule of thumb would add another 20% to Westport’s liabilities.

I estimate that putting all this together would make the unfunded pension liabilities a minimum of $52 million, or at least 3 times larger than the $17.3 million stated. This plus the unfunded health benefits make a combined liability a minimum of $100 million instead of the $57 million reported.

The $100 million unfunded liability is 556% of the town’s annual payroll. As Senator Everett Dirkson said, “$65 million here, $100 million there; pretty soon you are talking about real money.”

One way to make the number meaningful to an individual citizen is to express it as a cost per person. With Westport’s population of 15.5 thousand this number becomes $6,500 per person or $26,000 for a family of four.

These numbers are high because of the structure of employee benefit plans to which the town is agreeing. As an example employees are able to work 20 years, retire at age 50, and collect 40% of their salary for their life expectancy of 35 years. This is out of line with most private plans where an employee works for 35 years and collects a pension for 20 years.

Retirees who have 10 years of service are eligible to receive complete health care benefits for an average of 35 years.

For its pension plan the town has 257 retirees and 226 current employees, that is, more retirees are drawing benefits than employees who are working. It should be the other way around. There should be more people working and contributing to the plan than who are retired and drawing money from the plan.

The respected and independent Pioneer Institute in Boston has examined the true cost of public pensions in Massachusetts and rated the performance of their Pension Fund Management in terms of funding of liabilities.

The Bristol County Pension Plan is funded at 59.3% of liabilities assuming an unlikely return of 8.25% of assets. The Institute gave Bristol County a grade of F for their funding ratio. By comparison the prospectus for Westport’s recent bond offering shows that its part of the Bristol County fund is funded at 56.7% of liabilities or even below that of Bristol County as a whole. What grade should Westport’s Selectmen and Finance Committees be given? Less than that of Bristol County. Maybe Fminus.

The decisions that the Town has been making, granting generous benefits and leaving their payment for future taxpayers has already run up a bill of at least $6,500 for each man, women, and child living in Westport. For the sake of transparency the Finance Committee and the Board of Selectmen should explain to the taxpayers at town meeting that this is the commitment that they have made and that it is growing, and that it is good for them to continue bestowing benefits and leaving their payment for the future and why each person should be content with a debt of $6,500 that is spiraling upward.

Thomas Jefferson opposed the government running up debt to pay for its operations. He said, “We must not let our rulers load us with perpetual debt... It is incumbent on every generation to pay its own debts as it goes”. “Each generation should inherit the earth free of debt. If the dead can encumber the living with debt, then earth belongs to the dead and they are controlling it from the grave.”

“…neither the legislature, nor the nation itself, can

validly contract more debt than they may pay within their own age, or within

the term of 19 years And that all future contracts …should… be deemed void as to what shall remain unpaid at the end of

19 years (from their date of issue)

This would put the lenders, and the borrowers also, on their guard.”

It is time for the Town boards to bestow only those benefits for which the town is willing to fund immediately and to begin funding the plans 100%.

Richard Phillips is a

Westport resident. He was an Assistant Professor of Physics and Electrical

Engineering at the University of Minnesota and the founder of International

Polarizer.